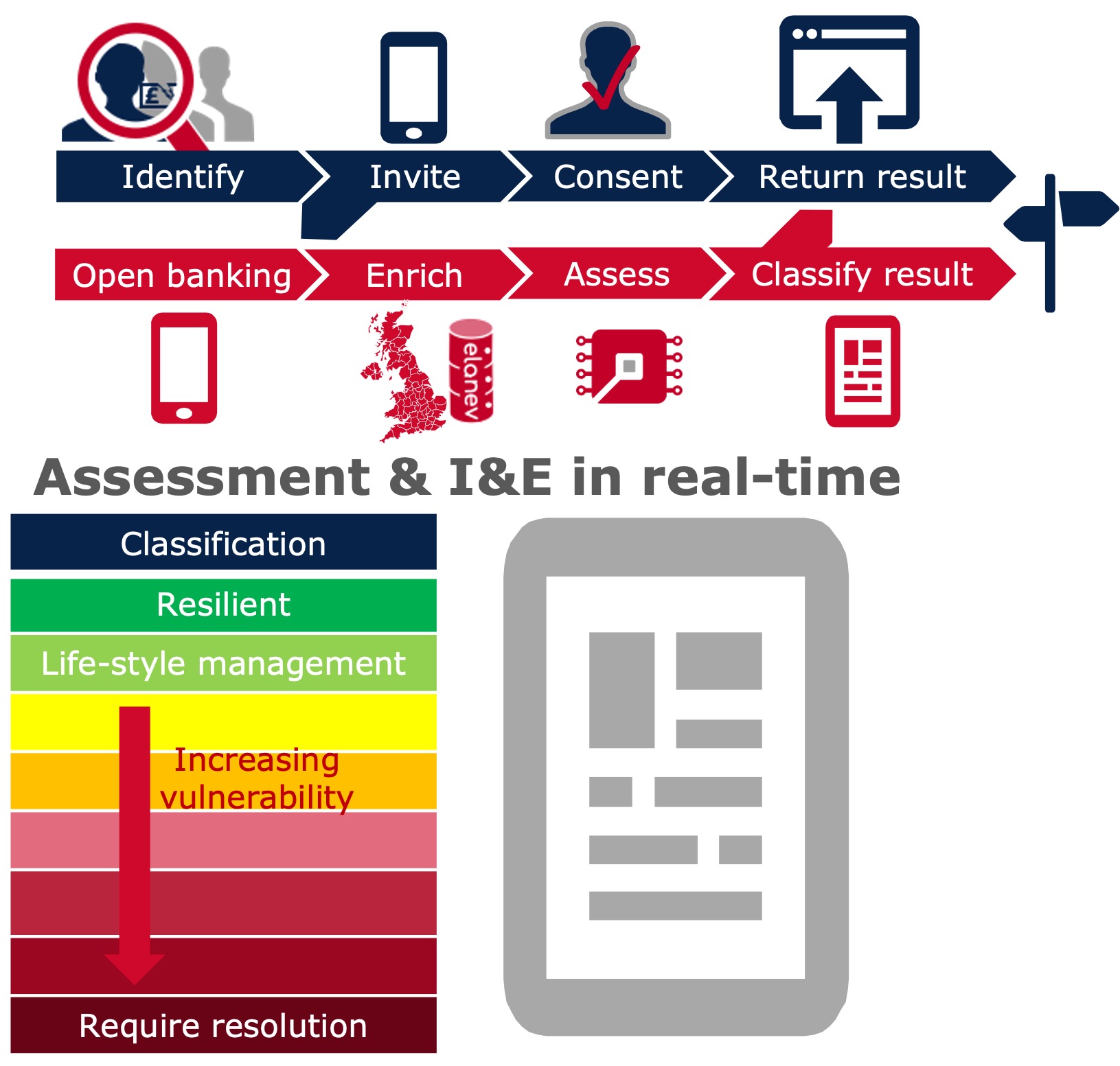

elanev IDV returns an individual consumer financial vulnerability assessment against a configurable scorecard and a populated I&E in real-time.

Financial vulnerability assessment

- Gain a more accurate financial vulnerability assessment using bank transaction data and elanev Data on savings, equity and assets

- Align the assessment to your policies with a configurable scorecard to ensure the most appropriate treatment for each consumer

- Reduce time and cost of accurate financial vulnerability assessment and I&E completion

Improving outcomes

At Leading clients

In live applications clients have reduced the cost of agent lead self-certification I&E completion and self-declared financial vulnerability by c75% whilst increasing data accuracy and reducing consumer stress.

“Our consumers really value elanev IDV. It is simple to use and gives a robust, configurable assessment of individual consumer financial vulnerability in real-time.”

Darren, MD, Ascendant Solutions.

Easy to implement

No IT change required – we deploy using our secure software as a service (SaaS) approach and REST APIs.

Consent consumer data – Consented consumer data is only used to provide the assessment.

Save on OPEX – elanev IDV will increase your operational efficiency so you can reduce costs.

Pilot it now

Experience the significant business benefits of elanev IDV for yourself. Contact us to request a no obligation pilot. You could be live within a week.

Frequently asked questions

READ MORE

What is elanev IDV? elanev IDV is a individual consumer level assessment of consumer financial soundness. It is made using consumer consented open banking data. elanev Data is used to provide a measure of savings, assets and equity together with the consumers transaction data provides a holistic view of financial soundness not available in other approaches.

Can the assessment be configured? Yes, the assessment is made against a scorecard which can be configured by the user to align to their own internal policies, processes and strategies. It allows a measurement of the extent of any financial vulnerability in terms of likely level and duration as well as lifestyle changes that may be required to bring individuals at risk of financial vulnerability to a configurable level of financial resilience.

Does elanev IDV return a populated I&E? Yes, we return a populated I&E. This comprises of the past 12 months of transactions averaged over a month as well as the latest month of transactions.

What data do you store? All data used is consumer consented. Having said that we do not store any raw open banking transaction data used in the provision of this service. We do not store any personal identifiable consumer information used in the provision of elanev IDV. We do store outcome data.